What makes a Bad Survey?

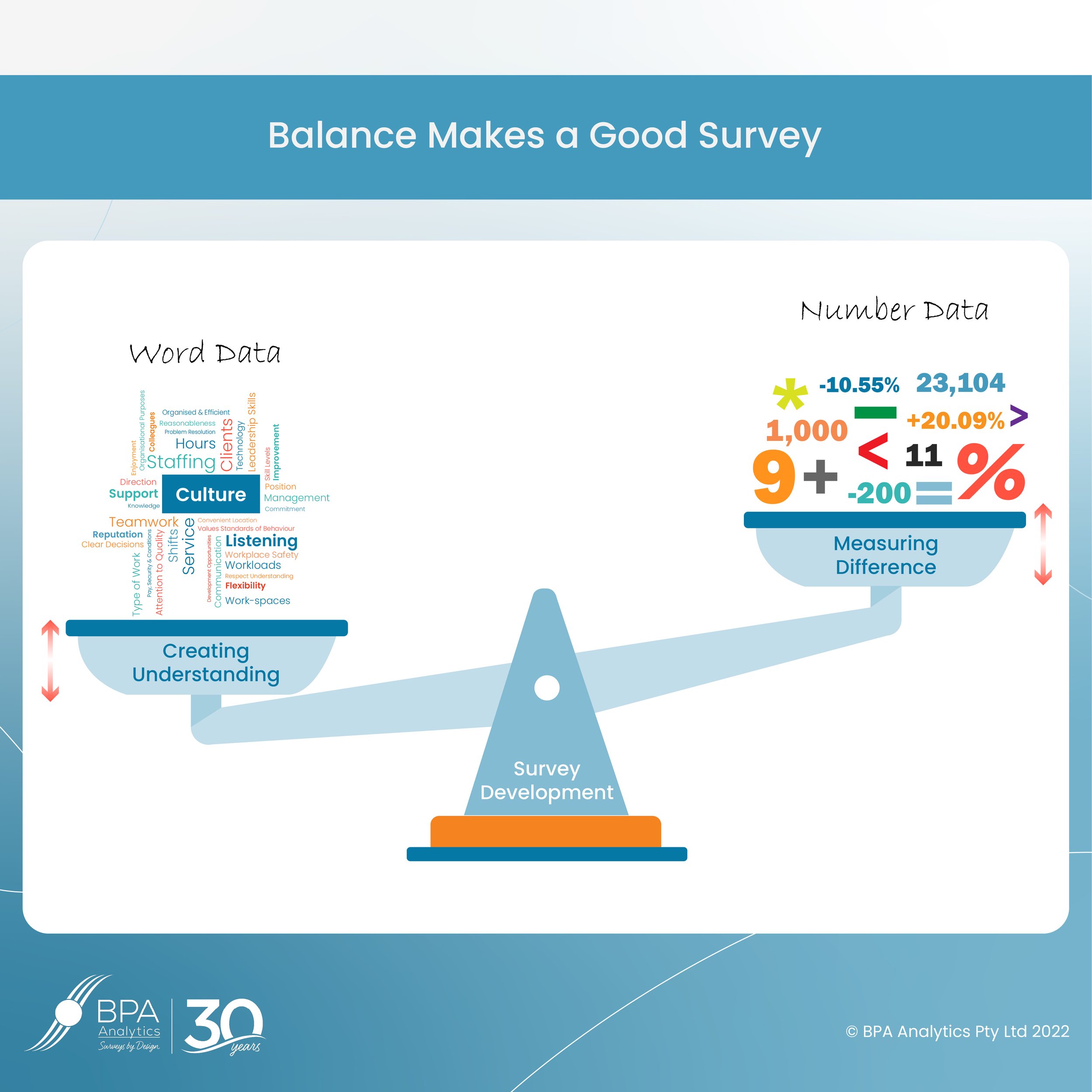

/A Bad Survey happens when you get the wrong balance between ‘Number data’ and ‘Word data’. Here’s why!

Numbers are good for measuring DIFFERENCE – difference over time (trending), difference from industry norms (external benchmarking), difference from targets and expectations (performance management), and so on.

But …

Words are better at creating UNDERSTANDING – understanding what people are thinking and why they do the things they do (behavioural motivators and drivers), understanding the causes of problems and what to do about them (management in general), understanding emerging opportunities and threats (strategic management), and so on.

So what is the optimum balance between ‘Number data’ and ‘Word data’? That depends on the purpose of the survey.

Pulse Surveys (also called Touchpoint surveys) are focused on evaluating change and so should be skewed towards generating ‘Number data’.

Many surveys (whether they are called Pulse Surveys or not) fall into this category. They are the simplest surveys to do but will often leave managers and executive dis-satisfied because they didn’t give them ‘real insight’ they can use with their decision-making.

Culture Surveys and most Employee Surveys are conducted with an unspoken expectation that they will create useful insights that managers and executive can apply in their decision making.

These surveys become ‘diagnostic surveys’ rather than tracking surveys and in these cases, the balance between ‘Number data’ and ‘Word data’ should shift towards more significant amounts of ‘Word data’.

This shift towards ‘Word data’ gives employees a much stronger sense of being listened to, of having their opinions sought and valued. It becomes a good way to engage employees in an ongoing conversation about current problems and future possibilities in the organisation.

Survey fatigue can become a problem with these types of surveys. Executive have to be careful not to ask too many questions and need to target the questions to specific areas of information need.

BPA’s average response rates for these diagnostic surveys is about 66%, but 80% plus is also quite common in organisations that are hungry for the added insight they deliver.